Main Street Macro: A soft landing for payrolls

December 11, 2023

|

Last week delivered the final job reports of the year from ADP and the federal Bureau of Labor Statistics. Today, we’ll dive into that data and discuss what it means for next year.

Last call: A slow but solid job market

The ADP National Employment Report is an independent measure of private sector employment. As such, there’s no reason to expect the job gains or losses ADP releases on Wednesdays to match the broader government data put out by the BLS on Fridays.

Last week, ADP reported a gain of 103,000 private sector jobs in November. The BLS reported a 199,000 increase in private and government non-farm payroll employment.

Yet the numbers are more in line than they might appear to be at first. ADP reported 103,000 new private sector jobs; BLS private sector gains were 150,000.

BLS counts the number of workers receiving a paycheck. As such, its November number included the 47,000 workers returning from strikes in the auto and entertainment industries.

ADP counts workers who are on a payroll, whether they received a paycheck or not. Adjusting for this methodological difference, ADP and BLS numbers reached the same conclusion: The labor market is slowing.

The end of an era

A deeper dive into the ADP data reveals one more year-end milestone – the end of big job gains tied to leisure and hospitality.

Hotels and restaurants have been the workhorse of the post-pandemic recovery, dominating hiring over the past two years as the sector rebounded. November data suggests, however, that the happy-hour hiring boom is over.

Leisure and hospitality shed 7,000 jobs in November, the sector’s third consecutive monthly slowdown. The industry percentage of workers hired in the past three months has fallen to 14.5 percent from 15.5 percent a year ago.

Leisure and hospitality was the only sector that saw double-digit pay gains during the recovery, a run that lasted 16 straight months before ending in February. By November, pay growth was 6.5 percent, low enough that it slowed wage growth for the labor market as a whole.

The return to trend in leisure and hospitality hiring also is being felt by small employers. Establishments with fewer than 50 workers make up 60 percent of employers in this sector, according to the Quarterly Census of Employment and Wages. So as sector hiring goes back to normal, the hiring strength of small employers likely will become more subdued.

New hire pay has landed

While some economists continue to debate whether the Federal Reserve can navigate a soft landing of the U.S. economy, I think new-hire data has settled that question. New hires have averaged $17 an hour for the last 10 months. By this metric, pay is flat from a year ago.

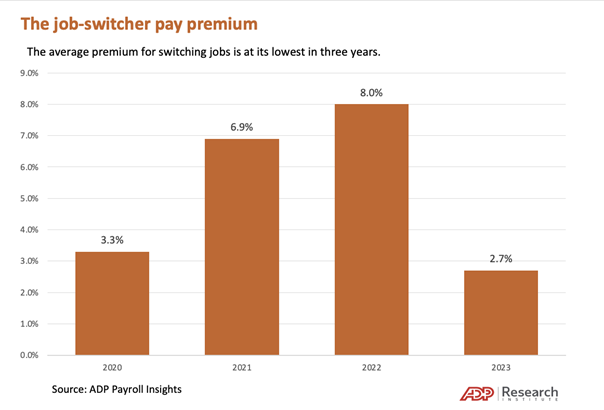

When we look at workers who we can track for more than a year, we see another steadying trend. The premium for changing jobs has narrowed to the lowest level in three years. The job-switching premium – the gap between job-changer and job-stayer pay gains – peaked in 2022 and has fallen by more than five percentage points since.

In 2024, job gains will be more modest and wage gains for newly created jobs also will be more subdued.

My Take

The 2020-2023 economy delivered the greatest labor market comeback story of all time, based in large part on small-employer hiring tied to leisure and hospitality. After losing 20 million jobs in the spring of 2020, the rebound has been extraordinary,

What happens next? The labor market is not without its scars. Manufacturing employment has been weak all year. Despite advances in generative AI technologies, job creation in the information sector has been lackluster. Hiring has been uneven in finance and professional business services.

Going into next year, the question is what sector can replace leisure and hospitality as the leader in job creation. Holding an early lead is health care, a sector that’s more resilient to higher interest rates and economic ups and downs.

The good news is that the unemployment rate has closed out the year near record lows at 3.7 percent. That points the way to a solid, if slowing, 2024 job market.