FEATURED POST

July 8, 2025

The pandemic changed the U.S. labor market. Here’s how.

It’s been five years since Covid-19 lockdowns brought parts of the U.S. economy to a halt. While the crisis has passed, its impact on the labor market, especially wages, is still unfolding. In February 2020, the U.S. economy was enjoying a Goldilocks moment. Unemployment was 3.5 percent, hiring was steady, and wages were rising modestly faster than inflation.

Read more

Subscribe to Data Lab

Stay up-to-date on the latest reports and trends.

Stay up to date with Data Lab

Please complete all fields.

Filter by:

April 15, 2025

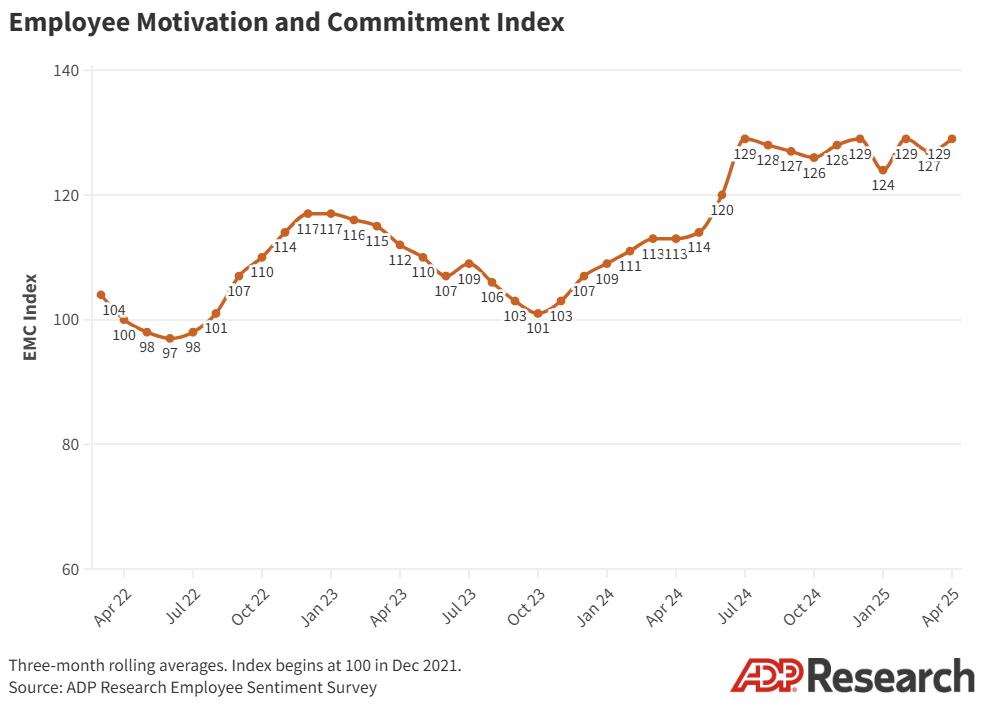

Employee sentiment index rose in April

by Mary Hayes, Ph.D. • Jared Northup

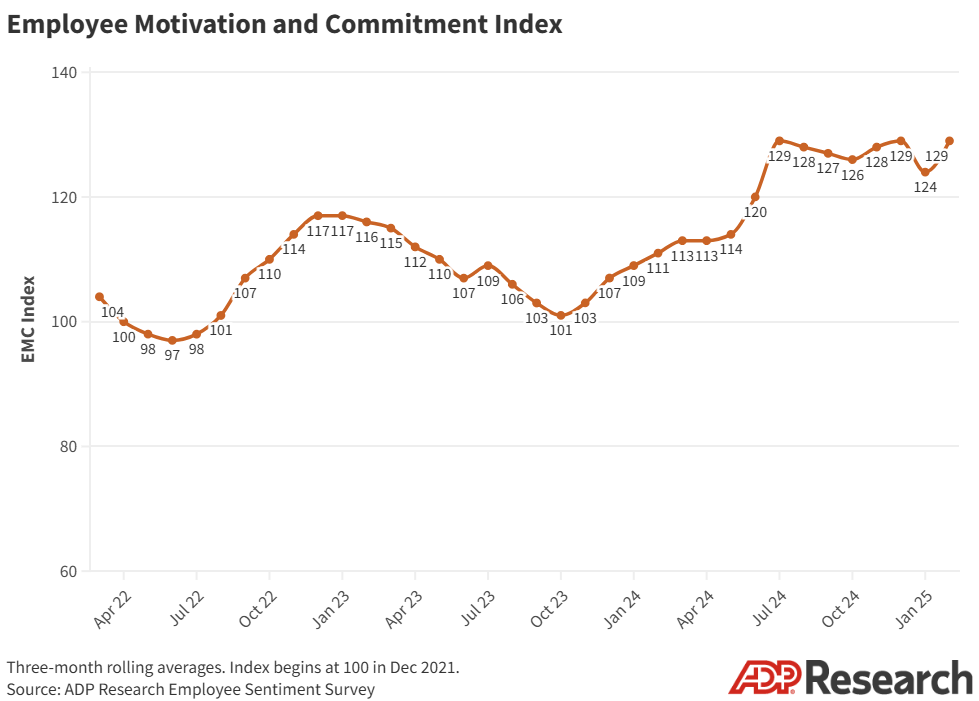

The ADP Research Employee Motivation and Commitment Index, which tracks how people think and feel about their jobs, gained two points in April to return to its series high.

Read more

February 18, 2025

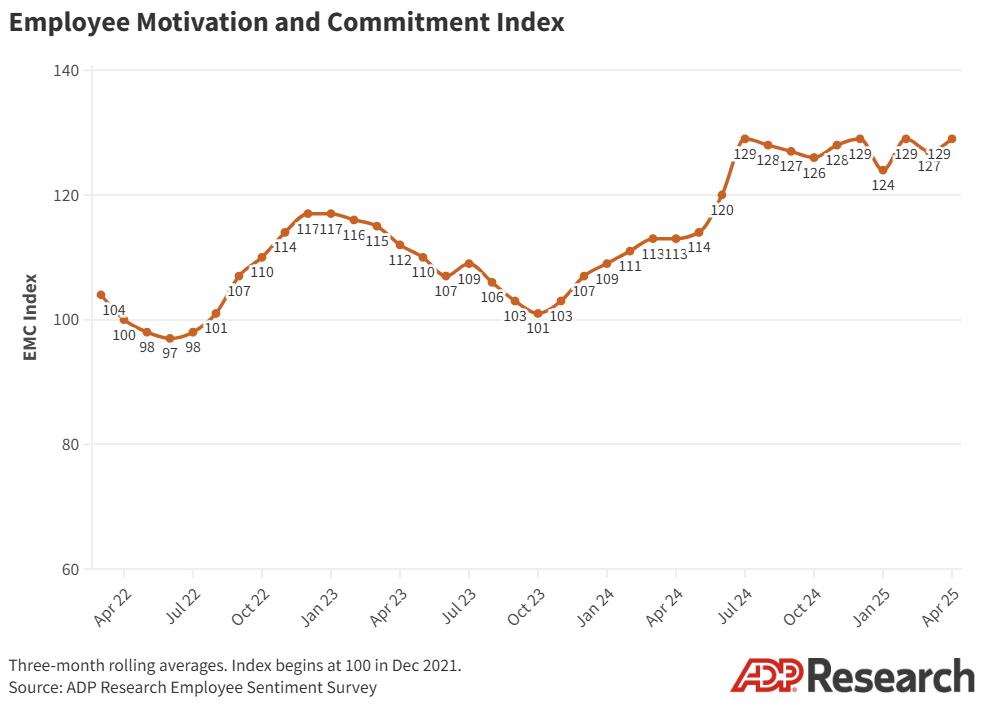

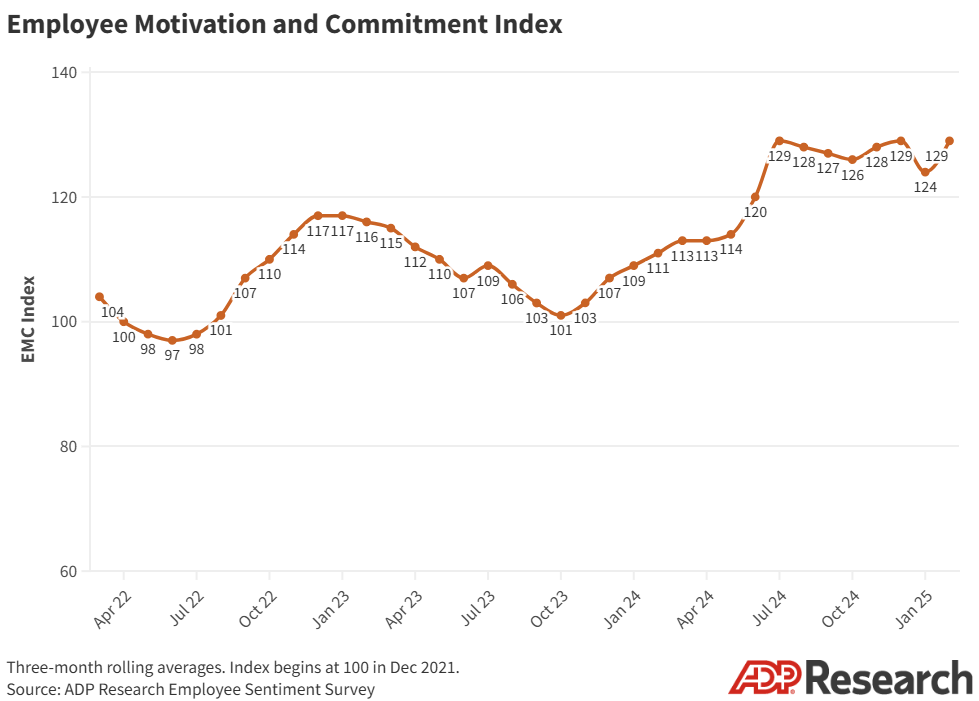

Employee sentiment rebounded in February

by Mary Hayes, Ph.D. • Jared Northup

Employee sentiment rebounded in February, gaining 5 points to match a record high set in July 2024. Two sectors—retail and wholesale trade, and information—hit new record highs.

Read more

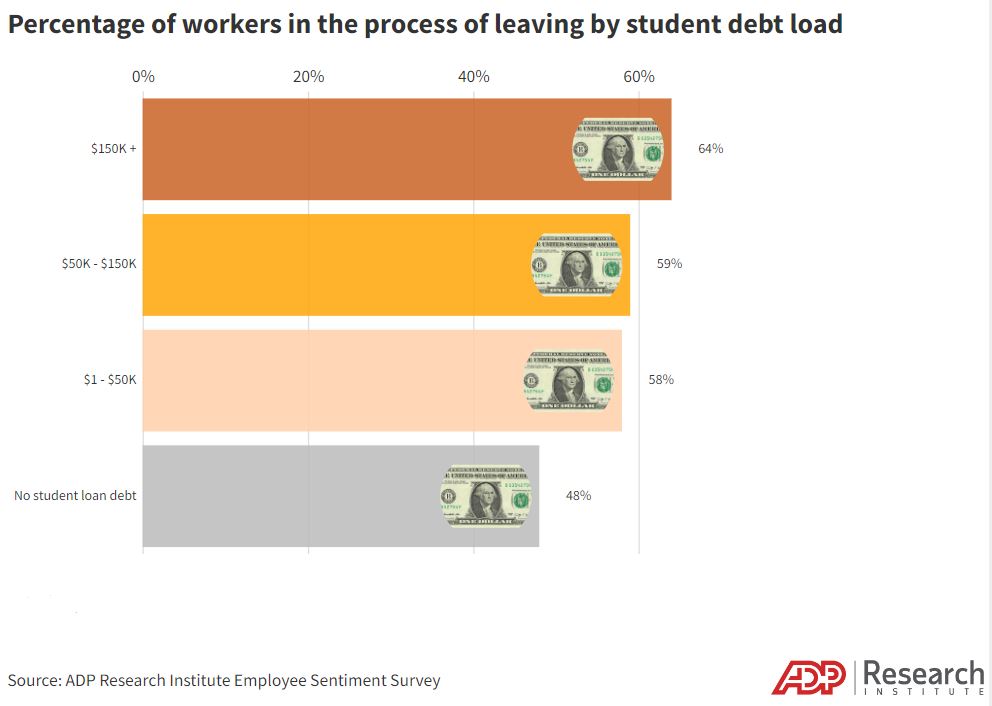

November 14, 2023

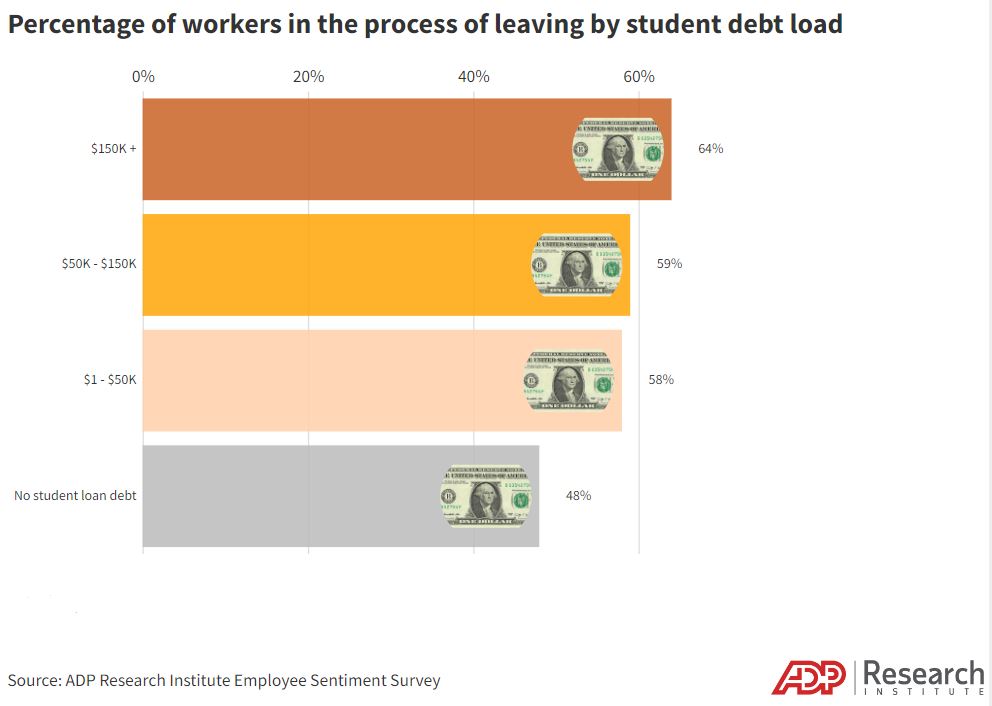

Employers and student debt

Student loan payments are back. Here’s why employers need to pay attention.

Read more

January 30, 2023

MainStreet Macro: Nela’s Recession Playbook

The biggest economic debate of 2023 is whether the U.S. is heading toward a recession. And the reason it’s being debated is because the data shows evidence for both sides.

In the no-recession camp, the economy grew by 2.9 percent last quarter, besting analysts estimates, and inflation slowed for the second straight month in December. And while we’ve seen big headlines on corporate layoffs, these job losses aren’t yet reflected in the data. Jobless claims for the first three weeks of January were near record lows.

Read more

January 23, 2023

MainStreet Macro: Shaking off the gloom in Davos

The annual World Economic Forum gathering in the mountainside retreat of Davos, Switzerland, is most commonly described with a single word: elite. After attending the meetings last week, I’d like to offer three more words that perhaps more constructively capture the ethos of Davos this year: Optimism, dealmaking, and hope.

Read more

January 17, 2023

MainStreet Macro: Minimum wages are rising. But is it enough?

Last week, data for December showed that the rate of inflation had fallen to 6.5 percent from 7.1 percent a year earlier. The decline was driven mainly by a steep drop in gas prices.

While overall inflation might (thankfully) be losing steam, workers, especially those with smaller paychecks, continue to suffer an erosion of the pay gains they reaped during 2022’s tight labor market.

Read more