MainStreet Macro: The stock market has a mind of its own

September 12, 2022

|

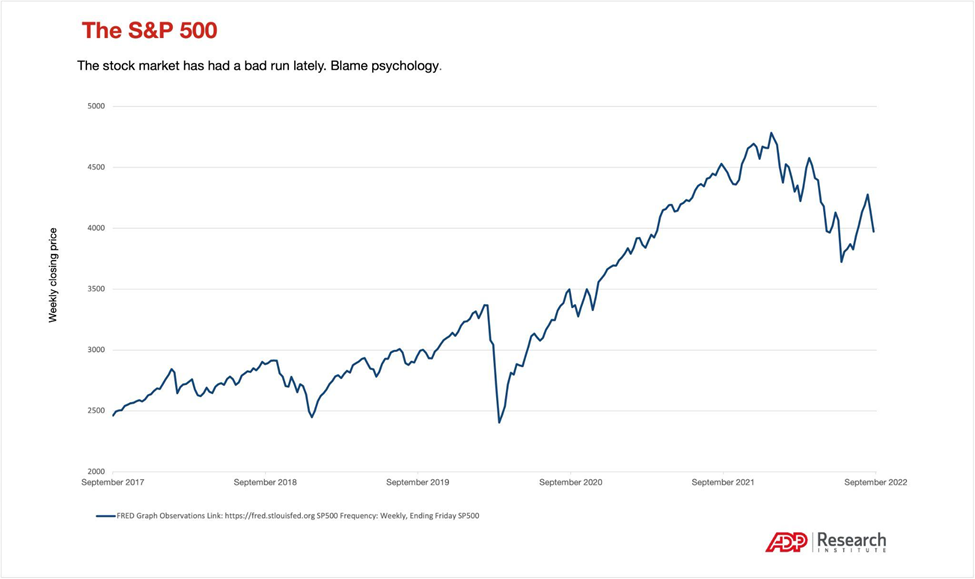

If you’ve been following equity markets these days, you’ll notice they’ve had a pretty bumpy ride. The S&P 500, a key index for measuring the financial health of the country’s largest companies, is down 17 percent from its December peak. While stock valuations in theory are based on corporate and economic fundamentals such as sales, profits, productivity, and growth, market psychology has the power to make or break a rally in prices.

I’m an economist, but this week I’m delving into psychology. Here are three things about market sentiment that Main Street needs to know.

Markets are future-oriented

A stock is an ownership claim on a company’s future earnings. Over the long run, stock prices are driven by the supply and demand for these claims. When public demand for stocks outstrips supply, prices go up, and vice versa.

But in the short run, a whole host of factors other than supply and demand can affect a stock price. One that stands apart, especially when there’s a lot of uncertainty about the future – as is the case currently – is market sentiment.

Market sentiment captures the degree to which investors are optimistic or pessimistic about the future.

Markets aren’t necessarily in lock-step with the economy

The stock market isn’t the economy, but its performance is guided by what the economy is doing. One way to think of the relationship between the stock market and the economy is to envision a dog and a dog walker.

On daily walks with my dog Lavender, I choose the direction and the pace. Still, even though she’s on a leash, Lavender sometimes runs ahead to sniff a flower. She might step backward if she hears a friendly bark and wants to play, or lurch sideways in an attempt to chase a rabbit.

Because she’s on a leash, she can’t stray too far from my direction, but she can and does pursue her own short-term whims along the way.

It’s the same with stocks and the economy. The economy always sets the pace and direction, but stocks have a mind of their own, with bursts of investor enthusiasm or anxiety along the way.

Markets sometimes interpret good news as bad news

Last week, the combination of a solid payrolls report from the Bureau of Labor Statistics and a favorable outlook for manufacturing from the Institute of Supply Management caused the S&P 500 to stumble backwards a bit before treading upwards the falling day.

Why would stocks fall on such good economic news? In a word, inflation. In three words, Fed rate hikes.

With inflation still hovering near a four-decade high, any suggestion that the economy might be overheating is met with investor hesitancy because of what it could mean in terms of Federal Reserve action on interest rates.

Higher rates affect demand for equities. They raise the cost of corporate capital and reduce the benefit of that future earnings stream we talked about earlier. In essence, they make it less rewarding to hold shares.

To be honest, I find this market behavior annoying. At the end of the day, what’s good for the economy is good for the markets.

(I also find it annoying when I want Lavender to keep pace with me, but she keeps getting distracted by bunnies, joggers, and passing cars).

My Take

While the stock market is important to Main Street, Main Street is way more important to the economy.

What both have in common is that, in the short term, they’re sometimes led by feelings, sentiment and the psychology of their members.

For the economy, that means consumer sentiment often drives spending and saving decisions. For the stock market, investor sentiment sometimes outruns, ignores, or lags economic and business fundamentals. What matters most to Wall Street and Main Street right now is that inflation falls back down to a more tolerable level and that everyone who wants a job has an opportunity to get one. That’s what keeps the economy moving forward – and pulling Main Street and Wall Street along with it.